þ | No fee required. |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

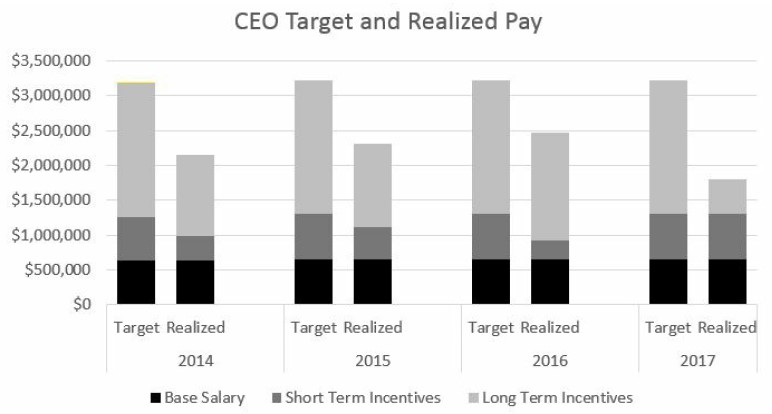

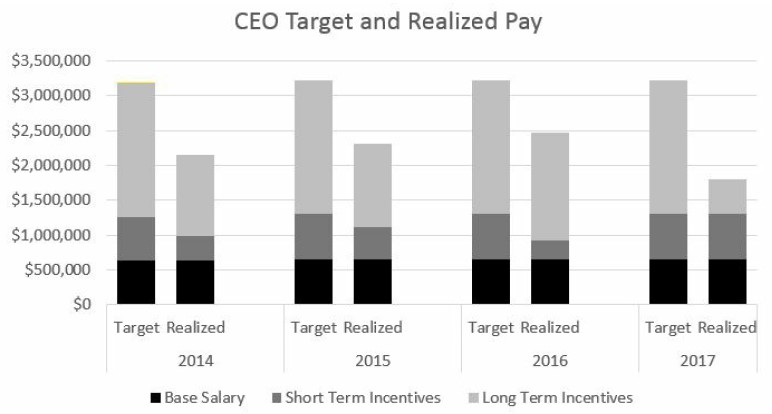

• | First, we believe, on the whole, our compensation programs continue to align compensation with the interests of the company. This does not mean that pay has stayed the same. To the contrary, although CEO Base Salary, Target Incentive, and Long-Term Incentives have remained structurally the same for the past four years, overall compensation has declined because the company’s stock price has fallen. In addition, features of our compensation programs – three-year vest periods and three-year rolling performance periods – ensure that performance in any given year continues to impact overall compensation in subsequent years. In other words, pay outcomes are clearly aligned with company performance. The following chart, which we included in the 2018 Proxy, shows target and realized pay, and illustrates the decrease in realized pay in the years in which the stock price (TSR performance) has continued to decrease. |

• | Second, we have worked to facilitate stockholder outreach and incorporate investor perspective. In particular, we engaged some of our large stockholders during the 2017 proxy vote to discuss ISS’s report and why we believed our stockholders should support the executive compensation proposal. Additionally, in meetings where investors indicated an interest in our compensation plans, we explained both the long-term and the short-term incentive compensation plans methodologies and targets in an effort to explain how we incentivize employees and management. Put simply, we have discussed our compensation policies and practices with key stockholders during the past year and clarified details regarding our short- and long-term incentive programs. Based on these discussions and the compensation plan changes we incorporated (as described below), the Compensation Committee believed at the time of the 2018 Proxy filing (and continues to believe) that it had addressed any concerns that stockholders and ISS have raised. |

• | Third, the Compensation Committee addressed each of ISS’s concerns in the 2018 Proxy. The 2018 Proxy included discussion of market review, program adjustments and thorough disclosure addressing ISS’s incorrect observations (including providing the CEO Target & Realized Pay chart above). Namely: |

o | STI Cap: In 2017, ISS was critical of achievement of the subjective component of short-term incentives despite missing financial performance thresholds. In response, despite the fact that actual 2017 performance would have yielded an above-target payout, the subjective component of STI was capped at target in 2018 based on the Company’s net loss for 2017. |

o | Rigor of Targets: In 2017, ISS asserted that the performance-conditioned long-term incentive components targeting the median of the peer group was not “particularly rigorous.” As a result, our Compensation Committee benchmarked our long-term incentive targets and required achieving a rank of 5th out of 10 companies to obtain target payout, which is more rigorous than in prior years, where target payout required 6th place rank out of 11 companies. |

o | Grant Values: In 2017, ISS asserted that equity grant values and underlying share counts continued to increase despite negative TSR. In fact, the CEO’s equity grant values have not changed since 2013. We believe ISS mistakenly calculated an “increase” in grant value due to the difference in the “grant value” used by the Compensation Committee (the trading price 30 days preceding the grant), and the “Fair Value” (FV) which is the basis for valuation required in the Summary Compensation and Grants of Plan Based Awards tables. To address ISS’s concern, we explained this discrepancy in evaluation of the Committee’s intended grant value in the 2018 Proxy in more detail. |

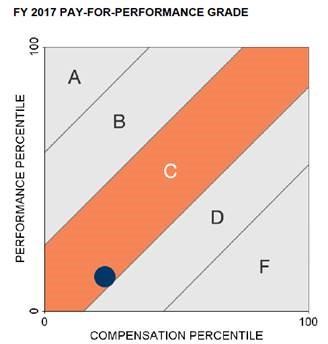

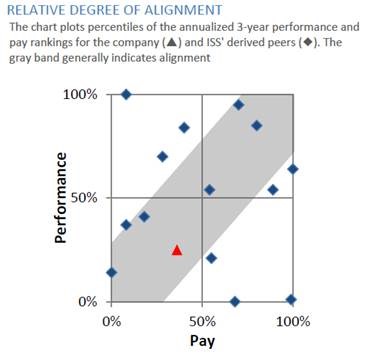

Table from Glass Lewis Report: | Table from ISS Report: |

|  |

Sincerely, |

/s/ Richard D. Paterson |

Richard D. Paterson |

Presiding Director |